A potential war with Iran and the impact on trade

A wider conflict with Iran would be negative for most types of ships and for the oil markets in general. Fewer ships will transit the Straits of Hormuz. The following analysis from VesselsValue’s Trade Analyst, Court Smith, focuses on VLCCs, which lift most of the crude cargo volumes out of the Arabian Gulf.

In the tanker war of 1987-1988 (Operation Earnest Will), U.S. vessels escorted ships through the Strait of Hormuz by reflagging Kuwaiti tankers temporarily under the U.S. flag. Rates for ships fell overall as tensions pushed up the price of oil at the start of the war, eroding TCE returns and reducing demand for Arabian barrels.

War risk cost

Events already have led to a higher war risk cost. This will be borne by someone, most likely the charterer according to the current war risk clause wording. However commercial terms will be negotiated on a case by case basis. Armed guards are also a possibility, which introduces an additional cost and escalates overall risk.

Effects on trades

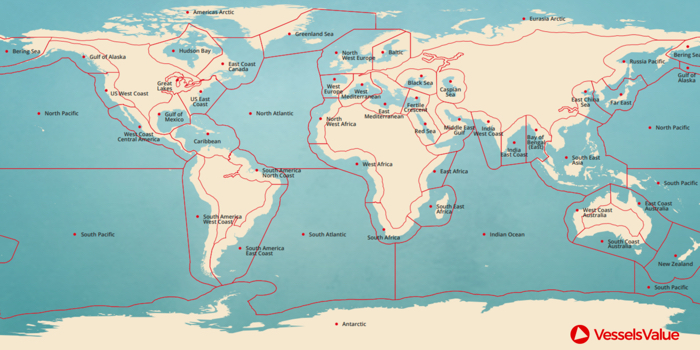

We would expect to see a significant increase in exports from other key oil producing countries who can provide seaborne trades. This chart shows the regional loading trends of VLCCs from the start of 2013 to the present. Red Sea loadings would increase almost immediately as Saudi Arabia would maximise the export volumes they could send through their port facilities. U.S. crude exports which continue to debottleneck would surge upwards as pricing differentials would encourage more exports, and more west African barrels would be brought online. A likely outcome would be an immediate relaxation on the Venezuelan sanctions, which have a more discretionary basis for their implementation, so the Aframax trade in the Caribbean could see a surprise resurgence.

Putting aside other sources of crude oil, the next step is to look at the destination for most Middle East Gulf VLCC exports. Countries in the far east dominate the destinations for VLCC cargoes out of the Arabian Gulf.

Oil flows to Asian refiners and India would be disrupted. This would reduce refinery crack spreads in these countries, discouraging runs. There would be some demand destruction as a result of price increases, but the markets these refineries support would seek refined oil products from other regions, which would benefit U.S. and European refiners who have easier access to Atlantic Basin trades.

Rising tensions could spur renewed interest in some offshore projects outside the Arabian Gulf, and producers may seek to optimise production from offshore locations depending on the severity of the conflict. Regardless, the increased probability of supply disruptions will nudge the dial on some investment decisions towards yes.

Market effects

The main result would be higher oil prices, resulting in lower demand for oil products in the short and medium term. Producers outside the Arabian Gulf would see the greatest benefit, particularly in the U.S., West Africa, and Brazil. These markets see more smaller crude carriers such as Suezmaxes and Aframaxes due to port limitations, but we would expect many VLCC ballasters to head to West Africa, Brazil, and the US Gulf.

For more information visit www.vesselsvalue.com

1st July 2019