Kinder Morgan Canada expects assets to continue to generate value in 2019

Kinder Morgan Canada (KML) expects 2019 to be a good year for the company. In its preliminary 2019 financial projections it plans to invest $32m in expansion projects. The company also expects to generate $213m of adjusted EBITDA and $109m of distributable cash flow. The figures reflect significant reductions from 2017 actuals and from its 2018 budget due to the Trans Mountain sale.

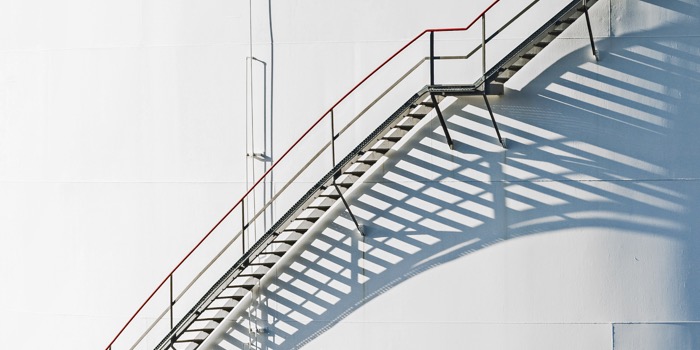

KML Chairman and CEO Steve Kean, said: “KML’s strategic assets include the Canadian portion of the Cochin Pipeline system transporting light condensate from the United States to Fort Saskatchewan, Alberta, one of the largest integrated networks of crude tank storage and rail terminals in Western Canada, and the largest mineral concentrate export/import facility on the west coast of North America. Those assets are expected to continue to generate substantial value for KML shareholders in 2019.

“As we have said previously, the original purpose of KML was to hold a strong set of midstream assets to provide a funding mechanism for the Trans Mountain expansion,” continued Steve. “In light of the Trans Mountain sale, which closed August 31, 2018, KML is evaluating all options in order to maximise value to KML shareholders. Those options include, among others, continuing to operate as a standalone enterprise, a disposition by sale or a strategic combination with another company.”

“We are continuing our evaluation of options with the KML board. As we have previously said, we will not provide further updates until we have something more definitive to announce.” Steve concluded.

For more information visit www.kindermorgan.com

4th December 2018