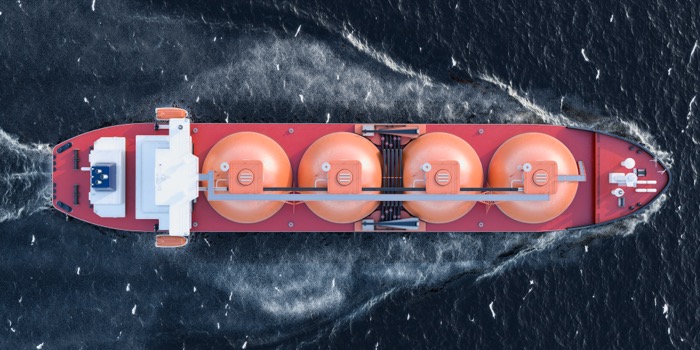

Tanker market edged higher during December 2020

The tanker market posted a mild rebound during the month of December. According to the latest monthly report from OPEC, dirty tanker rates experienced a slight improvement m-o-m in December, while still remaining near multiyear lows amid a persistent imbalance in tanker demand and availability.

VLCC and Suezmax rates saw some improvement on eastward rates from the Middle East and West Africa, as well as from West Africa to the US Gulf Coast.

Aframax rates edged lower, weighed down by a sluggish intra-Med performance. Clean tanker rates continued to see a pick up from multi-year lows seen at the start of the 4Q20, with gains both East and West of Suez.

As with the oil market and the global economy as a whole, 2020 was a volatile one for the tanker market. However, in contrast to the oil market, March and April were ‘golden’ rather than ‘black’ months as tanker freight rates soared to record highs in all major shipping regions.

Dislocations caused by the COVID-19 crisis resulted in an excess of crude in the market as consumption collapsed, overwhelming onshore inventories and leading to a surge in floating storage demand for both crude and products, all of which supported tanker rates across the globe.

By June, spot freight rates had fallen back to lower levels, where they remained for the rest of 2020. While ongoing efforts to address the imbalance in the oil market by OPEC and participating non-OPEC countries in the DoC may reduce tonnage demand in the near term, the tanker market will benefit as the reduced overhang stabilises oil trade trends, and as easing lockdown measures and a rollout of the COVID-19 vaccine support a return of economic activity.

For more information visit www.opec.org

25th January 2021